Netflix to acquire Warner Bros. Discovery for almost $83 billion

The streaming giant is about to officially enter Hollywood territory – here’s why that matters for everyone, not just for Netflix

KOSTAS FARKONAS

PublishED: December 6, 2025

Well, yours truly is not quite sure whether this was on anyone’s Bingo card for 2025 – it certainly wasn’t on his – yet here we are: Netflix won the recent bidding war for Warner Bros. Discovery’s assets and is set to own one of Hollywood’s most storied studios and its extensive content library. The streaming giant is now entering exclusive negotiations with Warner Bros. Discovery in order to finalize what would be the largest – and probably most important – acquisition in Netflix’s history.

The company has reportedly offered around $28-$30 per share for Warner Bros. Discovery’s studio and streaming business, a significant premium over the company’s current trading price of $7.50 per share that drives this acquisition’s cost fairly high for a deal of this kind (almost $83 billion). The proposed acquisition includes the HBO Max streaming service, the Warner Bros. film and television production studios in Burbank, as well as the company’s massive archive containing around 12500 films and 2400 TV shows.

Some of modern entertainment’s most valuable properties will be changing hands through this acquisition, such as the HBO network and its acclaimed series library – featuring the likes of Chernobyl, The Sopranos, The Last of Us and Game of Thrones – along with major franchises such as Batman, The Lord of the Rings, Harry Potter, Friends and DC Comics. These assets would dramatically expand both Netflix’s current content portfolio and its intellectual property holdings available for future projects.

Notably absent from the acquisition are Warner Bros. Discovery’s cable channels including CNN, TBS, and TNT. These (valued at more than $60 billion right now) will be spun off as a separate entity prior to the deal’s closing, consistent with Warner Bros. Discovery’s previously announced plans to split the company in two.

A bidding process full of drama

The path to Netflix’s winning bid was anything but straightforward. Warner Bros. Discovery CEO David Zaslav put the company up for sale at some point in October, sparking interest from multiple major players in the media landscape. Paramount Skydance (owned by billionaire Larry Ellison) and Comcast (which owns NBC Universal) both submitted competing bids, with early interest also reported from Amazon and even Apple.

Paramount proved to be a particularly aggressive suitor, with its lawyers publicly complaining that Warner Bros. Discovery “embarked on a myopic process with a predetermined outcome that favors a single bidder”, probably referring to Netflix. Paramount argued that its proposed deal would face fewer regulatory obstacles globally and submitted no less than three early bids that were rejected. Unlike Netflix’s, the offers of both Paramount Skydance and Comcast covered all of Warner Bros. Discovery’s assets, including its cable properties.

Zaslav’s team, however, maintained that separating the cable assets and pursuing separate deals for those would achieve the highest possible value for the company. For everything else, Netflix’s superior offer ultimately convinced Warner Bros. Discovery to grant it exclusive negotiating rights.

Regulatory challenges ahead, streaming consolidation a cause for concern

While Netflix won this bidding war, significant hurdles remain before the Warner Bros. Discovery deal is finalized: the acquisition is expected to face intense scrutiny from both the Federal Communications Commission and other regulatory bodies. Opposition has already been reported from the Department of Justice too, which will likely examine the deal’s impact on competition in the streaming and entertainment markets.

The regulatory risk is substantial enough that Netflix has reportedly agreed to a $5 billion breakup fee if the acquisition fails to receive approval from regulators. It’s a considerable financial commitment that’s, if anything, it’s underscoring Netflix’s confidence in its case. The deal will also require approval from regulators in multiple other countries, given the global reach of both Netflix and Warner Bros. Discovery. Reports even suggest that Donald Trump – who has close ties to Larry Ellison – may take a personal interest in the approval process, adding another layer of complexity to this regulatory review.

If approved, this acquisition could fundamentally reshape the streaming landscape and Hollywood’s traditional studio system. Netflix would transition from an online content distributor and producer to the operator of one of the industry’s largest and oldest studios, taking on responsibilities and business models it has avoided in the past. It will certainly be interesting to see how the streaming giant handles this challenging transition in practice.

One of the most significant questions surrounding this particular acquisition pertains to theatrical releases. Warner Bros. has maintained its commitment to releasing most of its films in movie theaters, which Netflix CEO Ted Sarandos has publicly called “an “outdated concept” as recently as this spring. Whether Netflix would actually honor Warner Bros.’ theatrical commitments long-term or shift the studio’s output primarily to streaming at some point remains unclear.

The fate of HBO Max as a streaming platform is another open question: Netflix could choose to merge HBO Max’s catalog into its own service – creating an even more dominant streaming platform in the process – or continue operating HBO Max as a separate, premium service that maintains its distinct brand identity and subscriber base.

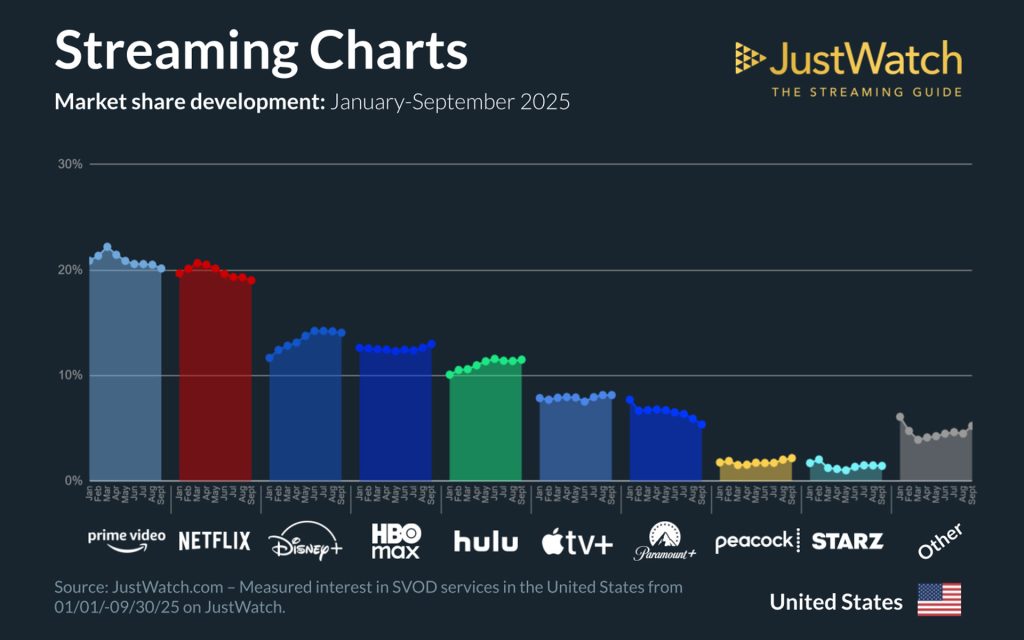

In either scenario, the deal would certainly change how and where consumers access some of the most high-quality, most successful entertainment content today. The consolidation of two major streaming services and their libraries into one, meanwhile, would definitely alter the subscription options associated with that singular service, as well as said content’s availability across the whole industry.

However things play out in the end, this acquisition already marks a historic shift for Netflix, a company that traditionally favored organic growth over major purchases. The deal – again, if consummated – would not only represent the company’s largest acquisition so far, but also signal a new strategic direction for the streaming pioneer. As negotiations proceed in the coming days, the entertainment industry will be watching to see whether Netflix can actually navigate the regulatory challenges ahead to complete this transaction. Bets, anyone?