Changes at the top of the US streaming market

Netflix pulls ahead of Prime Video in 2025, both dominant services under pressure as other players are gaining ground

KOSTAS FARKONAS

PublishED: January 17, 2026

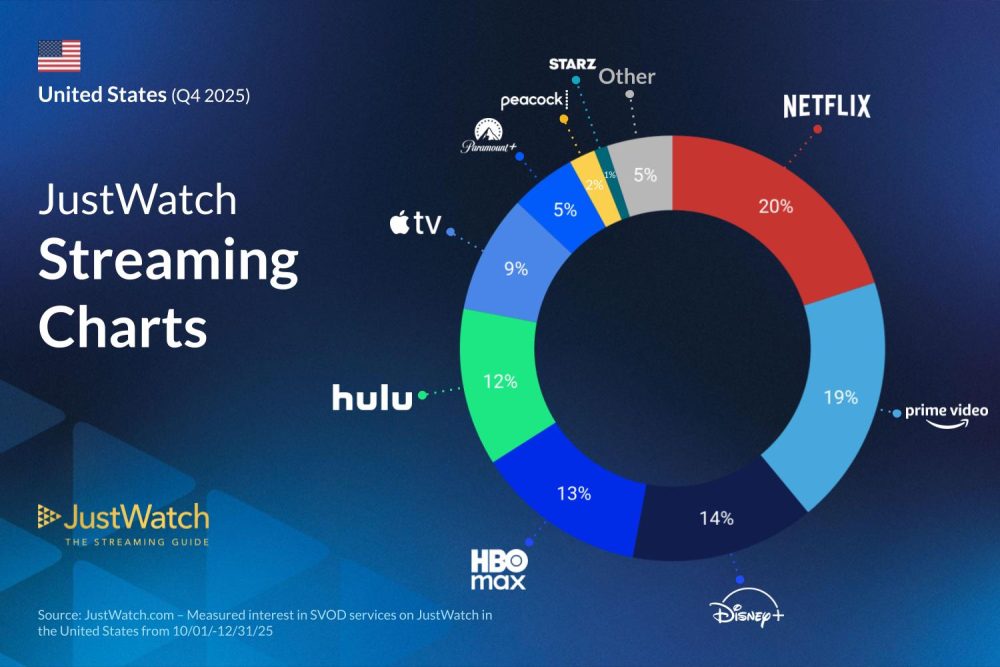

The US streaming market is going through an unexpectedly exciting transitional period, it seems, as even a single quarter is enough to bring about notable changes in terms of shares claimed by such services. According to new data from JustWatch – the online service tracking the viewing behavior of more than 20 million American users each month – Netflix overtook Prime Video at the end of 2025, becoming the most popular VOD subscription service. It did so after trailing Amazon’s service for some time – although, this being a single point of market share difference, it’s too early to say whether it’s a short-term, temporary win or a long-term, solid one.

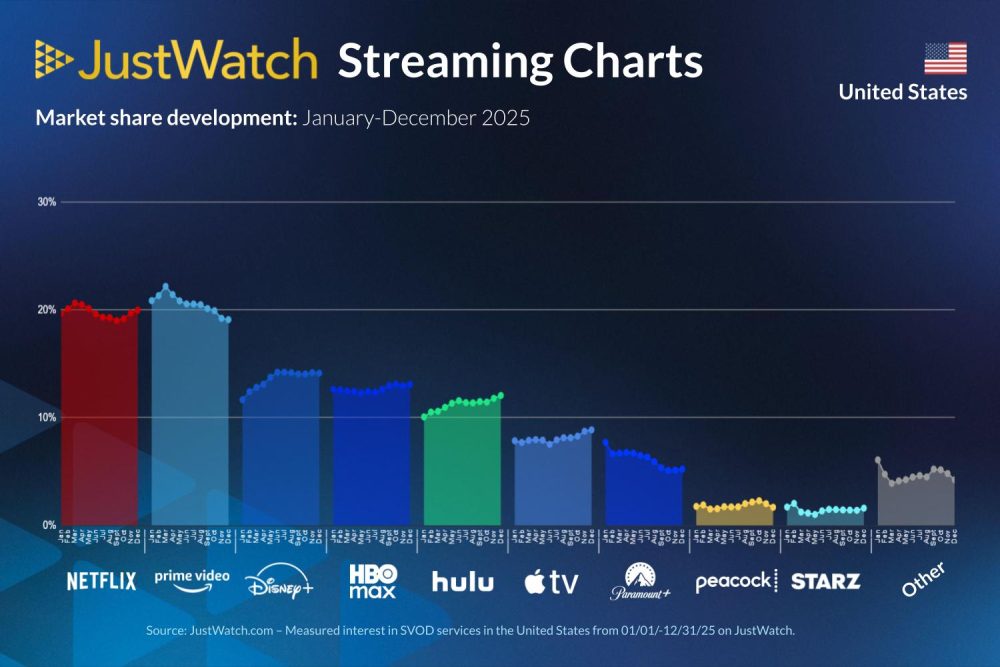

While Netflix and Prime Video trade blows for first place, though, they also feel more pressure than ever from challengers such as Disney Plus, HBO Max and Apple TV, all of which are steadily closing what once was an almost insurmountable gap. The latest JustWatch report – offering data for Q4 2025 so, essentially, for the past year as a whole – paints a clear enough picture: the dominance of the top two platforms is gradually giving way to a more balanced – definitely more competitive, which is always good for consumers – streaming services ecosystem.

Ιn the course of a decade Netflix and Amazon Prime Video have not just created, but basically shaped the subscription-based, modern video-on-demand market into what it is today. What these latest figures suggest, though, is that their absolute reign may be coming to a close: Prime Video now holds a 19% market share (down two percentage points from the previous quarter and three points year-over-year) while Netflix stands at 20% (gaining one point during the last quarter of the year). Both services seem to have peaked in early 2025 – at 22% and 21% respectively – but have seen steady declines ever since.

Meanwhile, Disney Plus commands a 14% market share of the US market: that’s an increase of two percentage points compared to last year and a sign of its long-term potential as a true challenger to Netflix and Prime Video. It’s worth noting that Hulu, also part of Disney’s streaming portfolio, now holds 12% of the US streaming services market (up by one from last quarter and up two points year over year). Its consistent performance in the mid-tier space perfectly complements Disney Plus’s upward trajectory, granting the parent company a combined 26% market share. That, notably, is well above the respective market shares of either Prime Video or Netflix now.

Smaller players are also doing better. HBO Max – stabilized after a period of uncertainty during the Warner Bros. Discovery restructuring – is showing signs of renewed strength: despite the news about it being acquired by Netflix, its market share held steady at 13% of the US market. Since its year-over-year numbers remain unchanged, HBO Max seems to have achieved a sustainable position in the mid-tier. Should the Netflix-HBO merger go through, there’s clear potential for a unified service of a combined 33% market share now.

Apple TV gradually became a notable player in 2025 too: it still holds 9% of the US market, but the service’s consistency stands out, both quarter over quarter and year over year (even as rivals like Paramount Plus fail to attract new customers). Apple’s quality-over-quantity strategy is showing long-term dividends and it may only take a small number of new critically acclaimed, award-winning movies or shows before it gets the attention of mainstream consumers (taking it to maybe 10% over the next 9-12 months).

What’s also interesting to see is that, while the spotlight often falls on the industry’s biggest players, smaller streaming services are quietly expanding their footprints. According to JustWatch, “Other” platforms collectively gained 2 points year over year, Peacock edged upward by one point year over year (now at 2%), while Starz held steady at 1%. These small gains seem to reflect the demand for curated, genre-specific or regional content offerings that can flourish along the mainstream, already successful ones.

The most important takeaway from this JustWatch Q4 2025 report, though, is clear: the US streaming market seems to have entered a new phase. With penetration rates already so high, subscription fatigue setting in and a challenging economic climate overall, for every player in this market – big and small – it will be less about acquiring new users and more about keeping them engaged and paying.

Netflix and Prime Video remain formidable, obviously, but their declines after years of dominance is marking a true turning point for this market. Disney Plus emerged as the clear leader among challengers, HBO Max is proving resilient and Apple TV is consolidating its position as a premium service. As the streaming wars evolve into a fight for engagement and loyalty -rather than sheer subscriber volume – this industry’s next winners will probably be those who deliver not just a lot of content, but consistent quality. Interesting times ahead, no?